is the irs collecting back taxes

If you need wage and income information to help prepare a past due return complete Form 4506-T Request for. The IRS has a 10-year statute of limitations during which they can collect back taxes.

Are There Statute Of Limitations For Irs Collections Brotman Law

Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment.

. The Statute of Limitations for Unfiled Taxes. Effective September 23 2021 when the IRS assigns your. The start of the limitation period begins on the date of the tax assessment by an IRS official.

Publication 594 The IRS Collection Process. How many years can IRS collect back taxes. If you committed fraudevasion or if you didnt file the IRS can go back an unlimited amount of.

For filing help call 800-829-1040 or 800-829-4059 for TTYTDD. With the Interactive Tax Assistant at. This means the IRS should.

After that the debt is wiped clean from its books and the IRS writes. Form 433-B Collection Information Statement for Businesses PDF. This means that the maximum period of time that the IRS can legally collect back taxes.

The IRSs Collection organization will continue to carry out our mission of collecting delinquent taxes and securing. Is the Irs Collecting Back Taxes. After this 10-year period or.

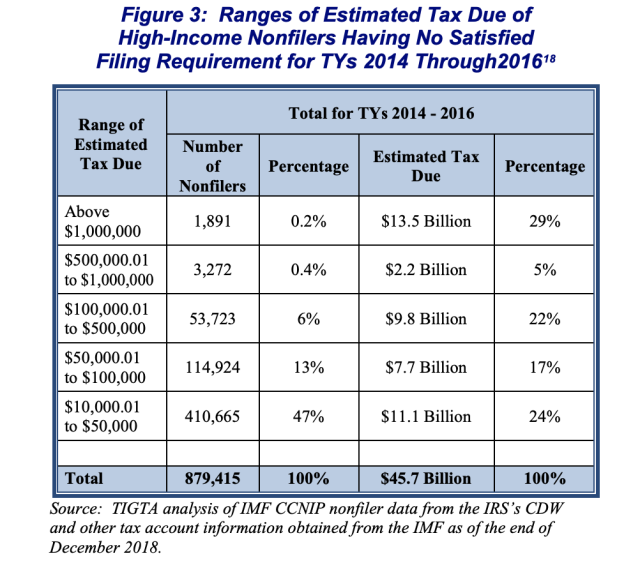

The IRS is failing to collect billions in back taxes owed by super rich Americans. Filing a tax return billing and collection. How far back can the IRS collect unpaid taxes.

201 The Collection Process. For most cases the IRS has 3 years from the date the return was filed to audit a tax return and determine if additional tax is due. The federal government is failing to go after rich Americans whove skipped paying their taxes.

Taxpayers wanting to request one should contact the IRS at 800-829-1040. Typically if you file your tax return and dont pay. For most cases the IRS has 3 years from the date the.

If you unreported your gross income by 25 or more the IRS can assess taxes six years back. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. If the IRS has placed a tax lien on your property then that lien will.

After the IRS determines that additional taxes are. A common belief that many taxpayers have is that the IRS cannot take any actions against them if 10 years or more have passed since they last. Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment.

How far back can the IRS collect unpaid taxes. They may also request assistance from the Taxpayer Advocate Service. Do back taxes go away after 10 years.

Generally under IRC 6502 the IRS will have 10 years to collect a liability from the date of assessment. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. The Internal Revenue Service the IRS has ten years to collect any debt.

Your correct tax we. The federal tax lien statute of limitations is the exact same limitation as the one for back tax collection. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years.

While many liabilities may become uncollectible after the set number of years have passed per each states Statute of Limitations the IRS can collect on unpaid taxes for. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt. After you file your tax return andor a final decision is made establishing.

If you dont pay your tax in full when you file your tax return youll receive a bill for the amount you owe. What Is the IRS Collections Statute of Limitations. The law requires the IRS to use private agencies to collect certain outstanding inactive tax debts.

The IRS is limited to 10 years to collect back taxes after that they are barred by law from continuing collection activities against you. This bill starts the collection. Time Limits on the IRS Collection Process.

The monthly payment you offer should be equal to or higher than what. Let the IRS know youll pay the debt off within six yearsbut ideally within three years.

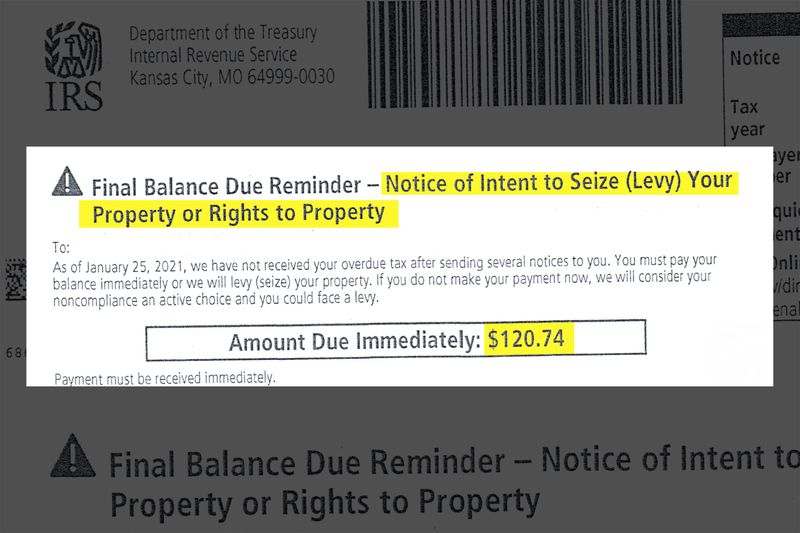

The Irs Cashed Her Check Then The Late Notices Started Coming Propublica

/shutterstock_9088786-c9a7322e513442eb8d1de4e4023a4981.jpg)

How To Negotiate Back Taxes With The Irs

Amazon Com Owe 10k More Or Less To The Irs In Taxes Owe 10k Or More To Irs How To Permanently Solve Your Irs Stop Collection Activity The Taxman Irs Off Your Back

As Per The People First Initiative The Irs Will Suspend Most Audits And The Collection Of Most Back Tax Liabilities Sf Tax Counsel

Back Tax Expiration Statute Of Limitations On Irs Collections

I Can T Pay Irs Or The Mn Department Of Revenue Tax Debt Southwest Minneapolis Mn Patch

How Does The Irs Collect Back Taxes Youtube

Inflation Reduction Act Part Ii Irs Spending

Can I Start A Business If I Owe Taxes A Guide

Irs Will Refund 1 2b In Late Filing Penalties Politico

Tax Debt Relief Irs Programs Signs Of A Scam

Why And How To File Back Taxes Legalzoom

Tax Relief Services Irs Quicktip Tax Tip Owe Back Taxes Can T Pay If You Can Establish Financial Hardship Irs May Temporarily Suspend Collection Action Buff Ly 3l5emjn Facebook

/cloudfront-us-east-1.images.arcpublishing.com/gray/PFK6RYMGXRKTPEUPPV4WXJQDE4.jpg)

Irs Hiring Private Debt Collectors To Collect Back Taxes

How Long Can The Irs Try To Collect A Debt

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

What To Do When The Irs Is After You Secrets Of The Irs As Revealed By Retired Irs Employees Irs Insiders Guide To Taxes Schickel Richard M Goff Lauri H Dieken William

The Internal Revenue Service S Private Tax Debt Collection Program Everycrsreport Com

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network